You have also not incurred any expenses yet for rent, electricity, cable, internet, gas or food. This means that the current balance of these accounts is zero, because they were closed on December 31, 2018, to complete the annual accounting period. Our discussion here begins with journalizing and posting the closing entries (Figure 5.2). These posted entries will then translate into a post-closing trial balance, which is a trial balance that is prepared after all of the closing entries have been recorded. Now that the journal entries are prepared and posted, you are almost ready to start next year.

Temporary vs. permanent accounts

- The retained earnings account balance has now increased to 8,000, and forms part of the trial balance after the closing journal entries have been made.

- ” Could we just close out revenues and expenses directly into retained earnings and not have this extra temporary account?

- Retained earnings are defined as a portion of a business's profits that isn't paid out to shareholders but is rather reserved to meet ongoing expenses of operation.

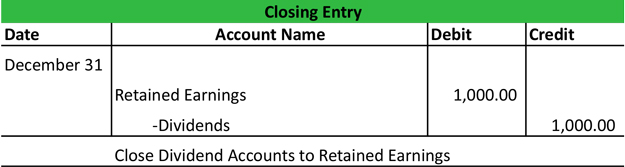

- The fourth entry closes the Dividends account to Retained Earnings.

Any account listed on the balance sheet is a permanent account, barring paid dividends. On the balance sheet, $75 of cash held today is still valued at $75 next year, even if it is not spent. They are special entries posted at the end of an accounting period. These accounts are be zeroed and their balance should be transferred to permanent accounts. Once we have obtained the opening trial balance, the next step is to identify errors if any, make adjusting entries, and generate an adjusted trial balance.

Our Services

Income and expenses are closed to a temporary clearing account, usually Income Summary. Afterwards, withdrawal or dividend accounts are also closed to the capital account. However, some corporations use a temporary clearing account for dividends declared (let's use "Dividends"). They'd record declarations by debiting Dividends Payable and crediting Dividends. If this is the case, then this temporary dividends account needs to be closed at the end of the period to the capital account, Retained Earnings. When dividends are declared by corporations, they are usually recorded by debiting Dividends Payable and crediting Retained Earnings.

Which accounts remain unaffected by closing entries?

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Net income is the portion of gross income that's left over after all expenses have been met. The term can also mean whatever they receive in their paycheck after taxes have been withheld.

The next and final step in the accounting cycle is to prepare one last post-closing trial balance. A net loss would decrease owner’s capital, so we would do the opposite in this journal entry by debiting the capital account and crediting Income Summary. Closing entries, on the other hand, are entries that close temporary ledger accounts and transfer their balances to permanent accounts. Take note that closing entries are prepared only for temporary accounts. After crediting your income summary account $5,000 and debiting it $2,500, you are left with $2,500 ($5,000 – $2,500). Because this is a positive number, you will debit your income summary account and credit your retained earnings account.

Close revenue accounts

Temporary accounts can be found in the accounting ledger, specifically the general ledger of accounts. This ledger is used to record all transactions over the specific accounting period in question. This list of general ledger accounts with their balances blog xero.nu is known as the trial balance. Thebalance in the Income Summary account equals the net income or lossfor the period. This balance is then transferred to the RetainedEarnings account. What is the current book value ofyour electronics, car, and furniture?

For our purposes, assume that we are closing the books at the end of each month unless otherwise noted. You can close your books, manage your accounting cycle, issue invoices, pay back vendor bills, and so much more, from any device with an internet connection, just by downloading the Deskera mobile app. Lastly, if we’re dealing with a company that distributes dividends, we have to transfer these dividends directly to retained earnings. For partnerships, each partners' capital account will be credited based on the agreement of the partnership (for example, 50% to Partner A, 30% to B, and 20% to C). For corporations, Income Summary is closed entirely to "Retained Earnings". Notice that the balance of the Income Summary account is actually the net income for the period.

The second entry closes expense accounts to the Income Summary account. The third entry closes the Income Summary account to Retained Earnings. The fourth entry closes the Dividends account to Retained Earnings.

The term "net" relates to what's left of a balance after deductions have been made from it. Then, just pick the specific date and year you want the closing process to take place, and you’re done! In just a few clicks, the entire financial year closing is streamlined for you. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Retained earnings are defined as a portion of a business's profits that isn't paid out to shareholders but is rather reserved to meet ongoing expenses of operation. Expert advice and resources for today’s accounting professionals.