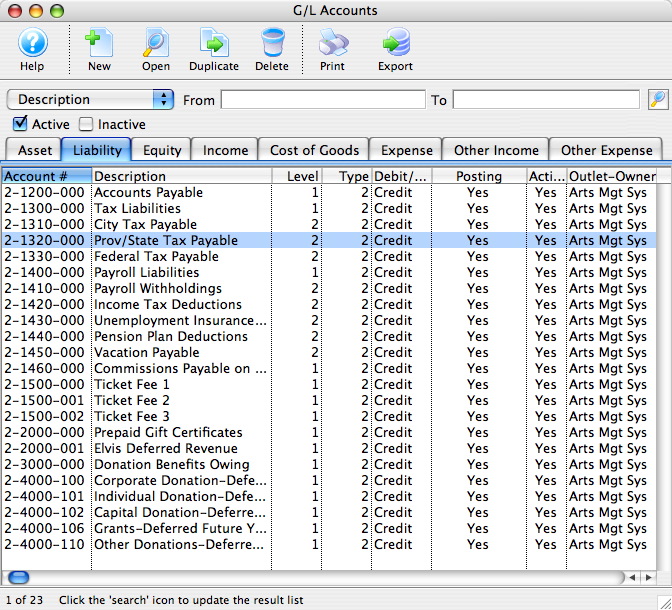

Think about the chart of accounts as the foundation of a building, in the chart of accounts you decide how your transactions are categorized and reported in your financial statements. To better understand how your current liabilities - credit lines, wages, etc. - should be organized, here's an example of accounts that would fall under this category and how they might be numbered. As a blueprint for your company's financial well-being, your chart of accounts will include several financial categories.

Best Practices for Maintaining an Accurate Chart of Accounts

- Customization ensures that a chart of accounts accurately reflects the unique activities and financial structure of a business.

- Track all of your accounting information - income, expenses, sales tax, payments, and more - in one place and run regular reports to review your company's financial statements.

- The chart of accounts allows you to organize your business’s complex financial data and distill it into clear, logical account types.

- Today, businesses manage countless complex and multifaceted financial transactions.

- As businesses grow, these technologies can adapt to changing needs, such as incorporating new accounts or modifying existing ones, thus offering scalability.

This organization aids in the efficient recording and retrieval of financial data. While the numbering scheme may vary with the size and complexity of the business, it generally follows a logical sequence aligned with account categories. Assigning numbers to accounts is a thoughtful process, designed to accommodate future expansions by reserving gaps for new accounts as the business grows or diversifies. Since these tangible items of value are considered assets, they'll start with "1." Here's an example of how you might organize this section.

You’re our first priority.Every time.

This categorization goes beyond merely adhering to accounting standards; it aligns with your business’s operational needs. For example, manufacturing businesses may require detailed accounts for inventory and cost of goods sold, cpa and accountant resources whereas service-based businesses might prioritize expense accounts related to service delivery. The numbering system forms the foundation of your chart of accounts, offering a structured method to organize financial information.

Chart of Accounts: Definition, Guide and Examples

The classification of assets and liabilities into current and non-current categories helps businesses and investors assess the financial health of a company. By examining the liquidity of a company, one can better understand the organization’s ability to meet short-term financial obligations and its prospects for long-term growth and stability. When setting up a chart of accounts, it’s important to establish a consistent and logical account numbering system. This numbering system, or coding system, assigns an identification code to each account, making it easier to locate and track different transactions.

All Categories

This will vary for your business based on the types of accounts your company actually uses, but it'll look similar. Unlike balance sheet accounts, income statement accounts close at the end of each accounting period. At this time, their balances are combined, and the net amount moves over to the balance sheet equity account. Integrating a COA with accounting software boosts automation and accuracy in your financial management processes. The software handles the tracking of transactions across different accounts, ensuring real-time financial data is both precise and easily accessible.

The general ledger serves as the central repository for all of a company’s financial transactions. Each account listed in the chart of accounts (COA) has a corresponding ledger account in the general ledger. Financial transactions are recorded in the appropriate ledger account, as dictated by the COA’s categorization, ensuring that transactions are organized and tracked systematically. Current liabilities are obligations due within one year or the company’s operating cycle, whichever is longer.

Organize it by account types—assets, liabilities, equity, revenues, and expenses. Within the assets category, for instance, you’d manage payables efficiently by creating specific accounts for varying types of expenses. Start with broad categories and drill down into specific accounts, leaving room for growth and ensuring clarity for financial reporting and analysis.

For example, asset accounts for larger businesses are generally numbered 1000 to 1999 (or 100 to 199), and liabilities are generally numbered 2000 to 2999 (or 200 to 299). Small businesses with fewer than 250 accounts might have a different numbering system. Every time you add or remove an account from your business, it’s important to record it in your books and your chart of accounts (COA) helps you do that.

It’s wise to review and update your CoA numbers at least annually to ensure they reflect any changes in your business operations, like new product lines or changes in regulation. However, more frequent reviews may be necessary if your business is growing rapidly or undergoing significant changes. Avoiding complexity might sound like a call to minimize detail, but that’s not the case—it’s about finding the sweet spot between the two for a CoA that optimizes financial tracking and decision-making. By considering these points, your CoA remains a dynamic tool that evolves and supports your business well into the future, ready to reflect any new change in direction or growth. We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals.

It’s not always fun seeing a straightforward list of everything you spend your hard-earned money on, but the chart of accounts can give you an important view of your spending habits. You can get a handle on your necessary recurring expenses, like rent, utilities, and internet. You can also examine your other expenses and see where you may be able to cut down on costs if needed.

These categories correspond to the major sections of financial statements (balance sheet and income statement). A chart of accounts organizes your finances into a streamlined system of numbered accounts. You can customize your COA so that the structure reflects the specific needs of your business. Similar to a filing cabinet for your company’s accounting system, it’s used to organize transactions into groups. In a chart of accounts, you’ll typically find an account number, account name, description, account balance, and account category.